You may have had conversations with insurance agents who were talking about and describing roof shapes. Specifically, hip and gable roofs. You might have even experienced a significant rate increase after binding coverage with a homeowners insurance company. How could this have happened? If the rate increase was around $400, it may have been due to a misquote by the agent who thought that your roof was a hip when if fact it’s a gable. So, What’s the insurance difference between hip and gable roof? We will offer our answer to this question in this informative article.

The Gable Roof

Before we delve deeper, let’s take a look at what a gable roof looks like. A gable roof is illustrated in the following image to your left.

As you can see, a gable creates an A or V formation. Two roof angles slope down from the roof peak or apex and it causes a triangular look. It is obvious to see that this type of roof can be weak in holding up to sever weather, especially when high winds are present. The gable roof has lower wind resistance, making it easier for your entire roof to rip off under the pressure of wind. Insurance carriers rate premiums on many factors. This is just one factor, but one of the most impactful. From the insurance carriers stand-point, this type of home should cost more to insure because the risk is far greater than a hip roof, which we will talk about in a minute. It’s important to know that you may get a way with a lower Florida homeowners insurance rate if your home possesses decorative gables (like above a window) with no load bearing effect on the structural integrity of your home. Some insurance companies allow for a certain percentage of a gable roof (generally 10%) as it relates to the overall predominate roof shape. They will grant you a hip rating if most of your roof is hip. This is where quoting insurance can get tricky. It’s best to pay for a wind mitigation inspection if you can’t determine whether you are entitled to a hip or gable rating. A wind mitigation inspector will ascertain this for you by measuring the roof line and indicate if the roof is gable or hip on the report. It’s not a bad idea to get this inspection regardless, because there are potential additional discounts that you may be able to receive from an insurance company that you would never have received otherwise.

As you can see, a gable creates an A or V formation. Two roof angles slope down from the roof peak or apex and it causes a triangular look. It is obvious to see that this type of roof can be weak in holding up to sever weather, especially when high winds are present. The gable roof has lower wind resistance, making it easier for your entire roof to rip off under the pressure of wind. Insurance carriers rate premiums on many factors. This is just one factor, but one of the most impactful. From the insurance carriers stand-point, this type of home should cost more to insure because the risk is far greater than a hip roof, which we will talk about in a minute. It’s important to know that you may get a way with a lower Florida homeowners insurance rate if your home possesses decorative gables (like above a window) with no load bearing effect on the structural integrity of your home. Some insurance companies allow for a certain percentage of a gable roof (generally 10%) as it relates to the overall predominate roof shape. They will grant you a hip rating if most of your roof is hip. This is where quoting insurance can get tricky. It’s best to pay for a wind mitigation inspection if you can’t determine whether you are entitled to a hip or gable rating. A wind mitigation inspector will ascertain this for you by measuring the roof line and indicate if the roof is gable or hip on the report. It’s not a bad idea to get this inspection regardless, because there are potential additional discounts that you may be able to receive from an insurance company that you would never have received otherwise.

The Hip Roof

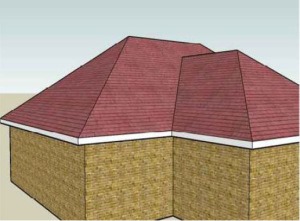

Now, let’s take a look at the hip roof as presented in the image to your right. As you can see here, all the roof sides slope downward toward the walls in a “pyramid” shape and no gables are present at all. This roof shape is more common with concrete block designs because all the walls are generally built to the same height. A wood frame home offers more gables on average. The hip roof is a more difficult construction method as it calls for more complex trusses or rafters. However, this type of roof adds an incredible amount of wind resistance to your homes overall integrity. It can withstand winds at very high speeds, sometimes over 120 miles per hour. It’s hard to say without having the statistics in front of us, but we see more hip roofs in Florida than gables. Gable roofs are certainly present in our state. We do notice more newer homes are being built with a hip style. 2002 and later homes are built to current code and most wind mitigation discounts are already given to you from the insurance companies automatically. There can be anywhere between a $100-$800 insurance difference between hip and gable roof depending on other factors.

all. This roof shape is more common with concrete block designs because all the walls are generally built to the same height. A wood frame home offers more gables on average. The hip roof is a more difficult construction method as it calls for more complex trusses or rafters. However, this type of roof adds an incredible amount of wind resistance to your homes overall integrity. It can withstand winds at very high speeds, sometimes over 120 miles per hour. It’s hard to say without having the statistics in front of us, but we see more hip roofs in Florida than gables. Gable roofs are certainly present in our state. We do notice more newer homes are being built with a hip style. 2002 and later homes are built to current code and most wind mitigation discounts are already given to you from the insurance companies automatically. There can be anywhere between a $100-$800 insurance difference between hip and gable roof depending on other factors.

Overall, most insurance companies will allow an agent to give a hip rating. So, if it’s obviously noticeable that your home possesses a hip shape, a hip roof geometry wind mitigation discount can be applied. Not all carriers allow for a hip discount unless a wind mitigation inspection is provided. RTC Insurance Advisors knows which carriers allow for hip rating without the need to pay for an inspection. Furthermore, we can measure your roof line with Google Earth to determine the percentage of gable before we send you homeowners insurance quotes for gable vs. hip roof. The best thing you can do is contact us if you have more questions at 352-200-2066 or fill out the questionnaire below to see if you are overpaying for your home insurance. Your current policy might have been coded for a gable rate when you should be paying less under a hip rating.