Many people want cheap homeowners insurance in Florida. Who really wants to pay a lot for anything? I know I don’t. The beauty about homeowners insurance is that the companies offer a lot of customizable options to help curb the high premium cost. When you receive a quote from an agent, you can always make adjustments. You aren’t stuck with the quoted premium. One of the only main parts of the policy that can’t be adjusted much is Coverage A (Dwelling). This amount needs to be set correctly to best cover your home for a re-build in the event of a loss. Agents use carrier supplied software to calculate the structure coverage. The most common software is 360 Value or MSB. From your home’s property appraiser record, an agent will input all the values found on the property appraiser record and the software will render a limit of coverage. Here are some ways to lower your rate.

Raise Your Deductible – If you are comfortable with raising your all other perils deductible (AOP) or “fire deductible” from $1,000 to $2,500, you will receive a lower premium. If the replacement cost limit of your home isn’t very high, you might even consider raising your hurricane percentage deductible from 2% to 5%. By raising your hurricane deductible, premiums can be reduced significantly.

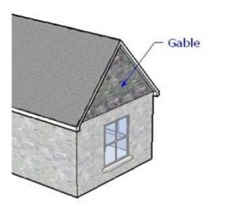

Get a Wind Mitigation Inspection – A wind mitigation inspection is not mandatory, but it might be a good idea, especially if you have put on a new roof after 2002 or your roof is gable. Often times, you will receive a large discount for having this inspection completed. Discounts are not guaranteed, but for an average cost of $85 to have the inspection done, it may be worth the risk.

Make Sure You are Receiving Your Discounts – Some companies will give a discount for having a good credit score, if retired, burglar and or fire alarms, being in a secured community and much more. Talk with an agent to make sure you are getting all the discounts your deserve.

We have many more ideas for you to lower your rate. Please call 352-200-2066 or fill out the form below so we can email you a quote. Let us know which company you are with when we speak and we will quote you new coverage. Together, we will tailor your policy for your specific needs. Chances are, you are no longer with a competitively priced company anymore and a switch is warranted. This might be your biggest savings of all.

We have access to 37 homeowners insurance companies and cheap homeowners insurance in Florida doesn’t have to be bad insurance.

Leave a Reply

You must be logged in to post a comment.